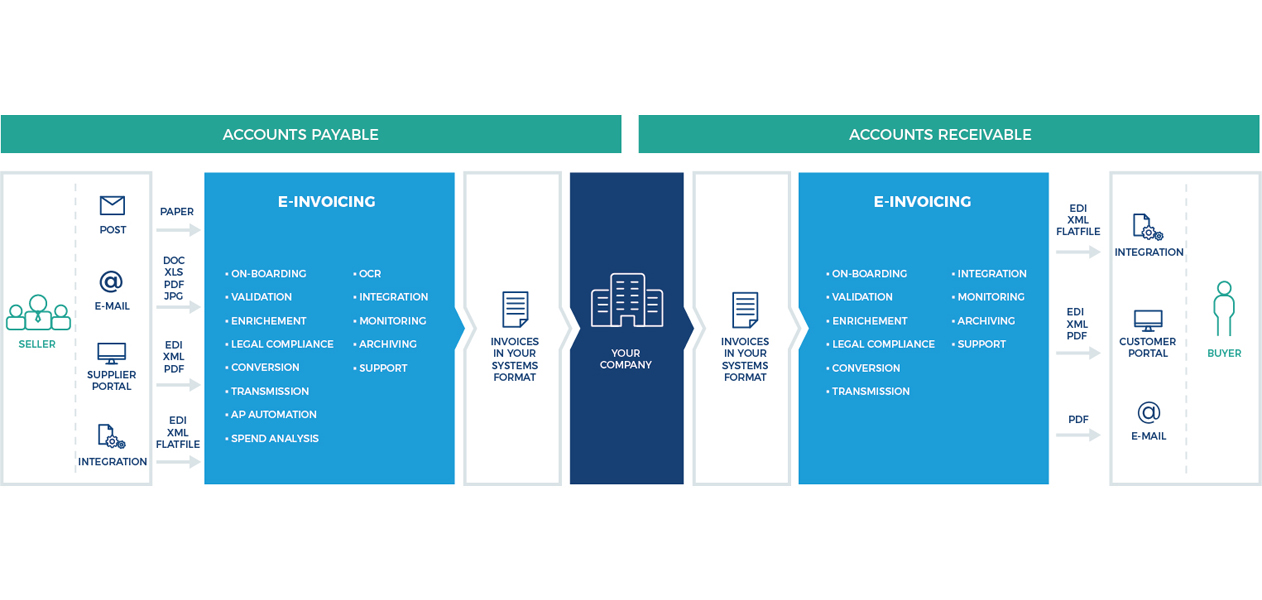

Due to Peppol’s four corner delivery model (pictured below) suppliers do not need to establish point-to-point connections to partners or use the same provider as prospective partners. As a result, those looking to achieve compliance with Norwegian regulations simply need a connection to a Peppol access point provider (such as ecosio). Helpfully, as already mentioned, Norwegian eProcurement relies heavily on Peppol and is dependent on both the Peppol BIS 3.0 standard and the Peppol eDelivery Network – particularly for cross-border transactions. Thankfully, compared to other European countries, many of which have complicated e-invoicing regulations due to complex federated legal landscapes, sending e-invoices in Norway is fairly simple. Meanwhile the more popular Peppol BIS format is used for both cross-border and national transactions, with CEF Digital estimating that the Peppol format is currently used by approximately 99% of contracting authorities. To accept EHF invoices receivers must be registered with ELMA (Elektronisk mottakaradresseregister).ĮHF is used exclusively between Norwegian organisations. In order to receive Peppol BIS messages all that is required is a connection to a Peppol access point provider. Both are based on UBL (Universal Business Language). Norway has implemented the European e-invoicing standard EN 16931, which has been reconciled with the pre-existing Norwegian E2B standard.ĮHF (Elektronisk Handelsformat) and Peppol BIS (Business Interoperability Specification) are the two document formats that Norwegian public bodies must be able to receive. Currently around 90% of all invoices sent to Norwegian public entities are e-invoices. There is now a monitoring system in place to track the use of e-invoicing with central and non-central public bodies. Similarly, all central government bodies issuing invoices themselves must also ensure their invoices conform to these standards. Further, those e-invoices sent must conform to the EU Norm, using either EHF or the Peppol BIS standard (in addition to being sent via the Peppol eDelivery network).

Since this date suppliers of non-central public bodies have also been required to send only structured electronic invoices. This made it mandatory for non-central Norwegian public bodies to be able to receive and process e-invoices. On 1 April 2019 regulation FOR-444 relating to electronic invoicing in public procurement was passed. Indeed, this legislation was passed two years prior to Directive 2014/55/EU, which in turn didn’t require countries to implement similar regulations until April of 2018.

By passing this legislation in 2012 Norway cemented itself as one of the most forward-thinking countries in Europe with regards to e-invoicing. In 2012 it became mandatory for partners of central Norwegian bodies to send only structured electronic invoices. Since 2011 central Norwegian bodies have been required to be able to receive e-invoices from suppliers. In this article we look at the current state of e-invoicing in Norway and what you need to do to ensure you are able to exchange automated electronic invoices with Norwegian partners.īut before we start examining the current state, let’s have a brief look into the past and the e-invoicing developments in Norway.

Compared to the other European countries required to implement regulations to meet EU Directive 2014/55/EU, Norway has achieved impressive results – with e-invoicing now extremely widely used in the country across both B2B and B2G transactions. For many years Norway has been leading the way when it comes to e-invoicing legislation.

0 kommentar(er)

0 kommentar(er)